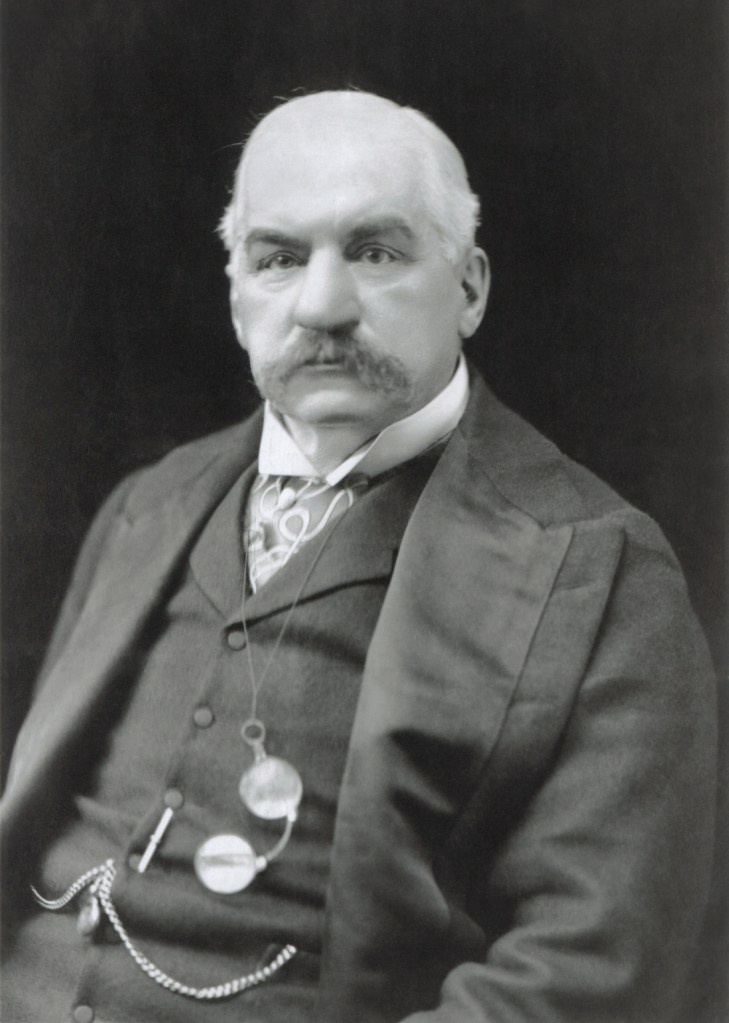

J.P. Morgan is a well-known American figure. He founded J.P. Morgan & Co. in the 19th Century and even today it remains one of the most powerful banking institutions in the world. To some, he is an example of the worst type of greed and corruption that can befall the American economic system, but to others, he is an example of the kind of success one can achieve in the United States. People can debate these two viewpoints on Morgan ad nauseam, but what they cannot argue is the fact that in 1907 Morgan was responsible for helping save the banking system of the United States.

In 1907, J.P. Morgan was nearing the end of his life. He would be six years from dying at the age of 75 in 1913. Morgan had experienced tremendous success in the railroad and steel industries but was most well known for his top spot in the finance and banking sector. McClure’s Magazine credited Morgan for shifting the power in banking from London to New York.[1] There was little left for him to accomplish except of course playing hero once more.

So what was happening in 1907 when the financial markets needed a savior? Put simply, the president of Knickerbocker Trust Company, Charles T. Barney, involved himself in a stock market manipulation scheme related to the United Copper Company.[2] Fearing the fallout from the scandal, customers flocked to Knickerbocker Trust to withdraw their deposits. However, as is common in these scenarios, the panic does not stay limited to one location. Customers of all the significant trusts were flocking to pull their deposits. Trusts were a relatively new invention in America. They operated as commercial banks but had far less regulation and infrastructure. They had nothing in place to help with these types of runs, and as a result, the entire trust banking sector was facing collapse. If a whole financial sector collapsed, the rest of the American financial sectors would follow since, in 1907, there were very few measures in place to prevent mass failures.

The most significant piece missing in 1907 was the Federal Reserve Bank. There was no government-sponsored institution that helped provide liquidity and stability to other banking institutions. What they had in its place were clearinghouses. Clearinghouses were groups of banks operating together to provide services to other institutions, including liquidity, when customers demanded cash withdrawals and the banks lacked the funds. The bank needing funds would take out a loan from the clearinghouse and use the cash to pay the depositors. It’s very similar to the Federal Reserve system implemented in 1913, except they were private businesses with private interests. They could say no to helping out a bank in trouble, and they proved that with the Knickerbocker Trust Company when they refused further assistance.[3]

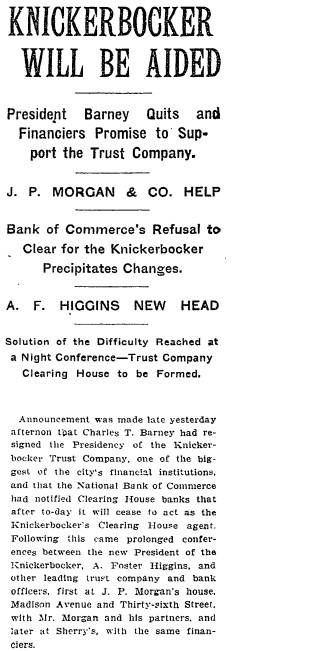

With everyone able to act in self-interest, who could the trusts turn to for help? Well, they turned to the biggest player in the game, J.P. Morgan. Approached by the failing trusts and other banking leaders, Morgan got to work quickly. He formed a coalition of bankers and directed agreements wherein these other banks would help the failing trusts if they were in need of cash.[4] Morgan forced the New York Clearinghouse to cooperate and supply much-needed funds to the trusts when it seemed like everything might be lost. He achieved this through pure force of will. If anything shows what a significant figure Morgan was during this time, it is when United States Secretary of Treasury George Cortelyou gave Morgan control of $25 million in government funds to use as he saw fit.[5]

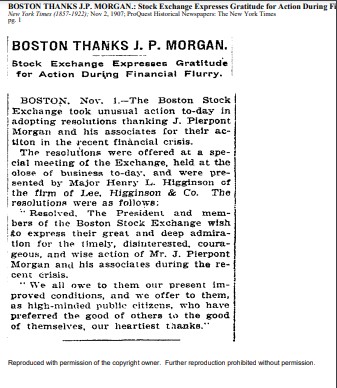

These efforts by Morgan were successful, and the run on banks stopped. The banking sector was saved, and the economy with it. The placement of Morgan as a hero is not a creation of historians. The New York Times wrote an article in November of 1907 wherein the Boston Stock Exchanged thanked J.P. Morgan for his contributions to correcting the situation. At the time, people knew Morgan was the savior.[6]

J.P. Morgan’s acting as the hero for the American economy in 1907 is more than just a good story. It is indicative of the state of American banking at that time. You had greedy individuals operating lightly regulated institutions. These individuals had the power to bring the entire economy down with a few bad decisions. You had an industry with no controls for when human emotion dominated reason. Bank runs are rarely logical and, by their very nature, lead to a greater risk of deposit loss. Finally, while Morgan showed that one person with good intentions could save everything, it displayed that too few had far too much power. A private banker being given government funds to act as a federal reserve is a flawed system. All this would explain why in 1913, the very year Morgan passed away, the Federal Reserve Act was passed.

[1] Ray Stannard Baker, “J. Pierpont Morgan,” McLure’s Magazine XVII, no. 6 (October 1901): 518.

[2] Robert F. Bruner, The Panic of 1907: Lessons Learned from the Market’s Perfect Storm , (Hoboken, N.J: John Wiley & Sons, 2007), xi-xii.

[3] Jon R. Moen, and Ellis W. Tallman, “Clearinghouse Membership and Deposit Contraction During the Panic of 1907,” The Journal of Economic History 60, no. 1 (2000): 150-51, http://www.jstor.org/stable/2566800.

[4] “Knickerbocker Will Be Aided,” New York Times (1857-1922) (New York, N.Y.), 10/22/1907, https://go.openathens.net/redirector/liberty.edu?url=https://www.proquest.com/historical-newspapers/knickerbocker-will-be-aided/docview/96736770/se-2?accountid=12085

[5] Chernow Ron, The House of Morgan : An American Banking Dynasty and the Rise of Modern Finance (New York: Grove Press, 2010). https://search.ebscohost.com/login.aspx?direct=true&db=nlebk&AN=2632499&site=ehost-live&scope=site&custid=liberty&authtype=ip,shib.

[6] “Boston Thanks J.P. Morgan: Stock Exchange Expresses Gratitude for Action During Financial Flurry,” New York Times (1857-1922) (New York, N.Y.), 11/02/1907, https://go.openathens.net/redirector/liberty.edu?url=https://www.proquest.com/historical-newspapers/boston-thanks-j-p-morgan/docview/96722409/se-2?accountid=12085

Leave a comment